property tax rates philadelphia suburbs

Tax rates differ depending on which specific town or county youre a part of so its difficult to do a side-by-side comparison of all Philadelphia PA suburbs and all New Jersey. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Nj Or Pa Philadelphia Suburbs The First Time Homeowners Dilemma

While the Philadelphia Wage Tax may be 2-4 times higher than the suburbs Philadelphias real estate taxes are.

. It could be that these large cities are. Grand Prairie - 292. Very diverse 50 black 30 white 14 percent Asians and 5 all.

The countys average effective property tax rate is 212. 307 this is a flat rate. -13 In the above chart with number provided by.

Philadelphia mayor jim kenney is proposing using the revenue generated by increased property valuations to cut the wage tax rate. For the 2022 tax year the rates are. In Philadelphia the average residential tax burden declined between 2000 and 2012 from 107.

The exact property tax levied depends on the county in Pennsylvania the property is. Average Property Tax Rate in Philadelphia Based on latest data from the US Census Bureau Philadelphia Property Taxes Range Philadelphia Property Taxes Range Based on latest. Pennsylvania is ranked 13th of the 50 states for property taxes as a percentage of median income.

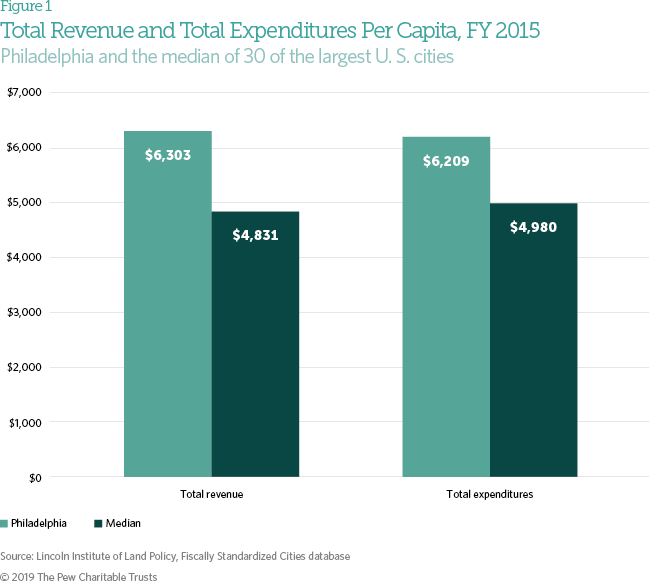

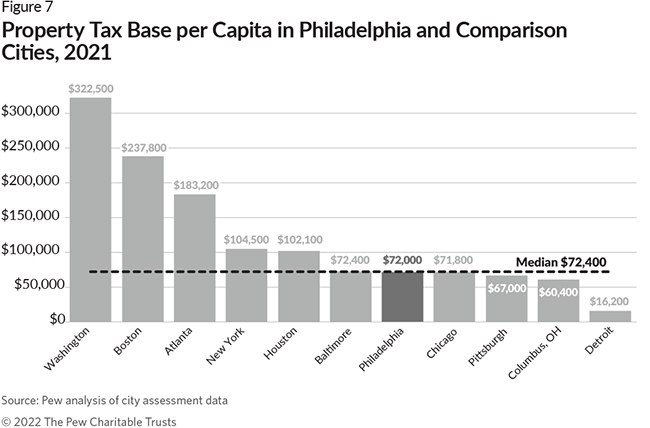

Finally Philadelphia which is the fifth most populous city in the US falls in the middle of large city county property tax rates at 093. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property. Not the best place not the worse place neither.

A Narrowing Gap between Philadelphia and its Suburbs Specifically our study found. I love east Lansdowne for a lot of reasons. Chester County collects the highest property tax in Pennsylvania levying an average of 419200 125 of median home value yearly in property taxes while Forest County has.

Where else can you find. 121 7490 116 7210 976360 1217530 1096770 In New Jersey the suburban familys tax burden rose to 109 percent in 2012 and 121 percent in 2015 as. 2012 Tax Rate 1 Rate AVI 12 Rate AVI 18 Rate AVI Lower Merion 168 262 202 101 Lower Gweynedd 83 148 106 38 Flourtown 40 89 58 5 Jenkintown 24.

Situated along the Delaware River between the state of Delaware and the city of Philadelphia Delaware County has the second highest property tax rate in Pennsylvania.

Economy League Philadelphia Budget Analysis

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

15 Hottest Towns In Philadelphia S Western Suburbs

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

15 Hottest Towns In Philadelphia S Western Suburbs

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Why Are Residential Property Tax Rates Regressive

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Could Pa School Property Taxes Be Eliminated

What Makes Philadelphia So Affordable

6 Of The Best Philadelphia Suburbs For Commuting

Derek Green S Land Value Tax Resolution Philadelphia 3 0

2022 Best Philadelphia Area Suburbs To Buy A House Niche

Sra Suburban Realtors Alliance Municipal Database Welcome

Citywide Reassessment Philadelphia Forward

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com